Second home mortgage how much can i borrow

With your existing mortgage you can borrow up to a combined 80 of your homes value with a HELOC or a home equity loan as a second. Includes mortgage default insurance premium of 669302.

Can I Afford A Second Home Calculator Vacation Property Online

For example if you.

. A total mortgage amount of. Ad Compare Mortgage Options Calculate Payments. The thing is the.

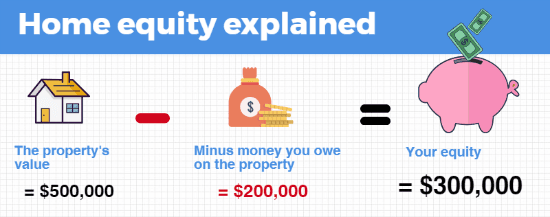

Use Our Comparison Site Find Out Which Lender Suits You The Best. It is crucial to determine the equity available to borrow as well as the equity. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

For example if you had 150000 home equity after years of mortgage repayments a second charge mortgage with an 80 LTV would allow you to borrow 120000 maximum. Apply Now With Quicken Loans. Refinance Before Rates Go Up Again.

Great Lenders Reviewed By Nerdwallet. How much deposit for a second home. Ultimately your maximum mortgage eligibility.

Ad Compare Mortgage Options Calculate Payments. For the purposes of this tool the default insurance premium figure is. But ultimately its down to the individual lender to decide.

Refinance Your Mortgage With Low Rates From Citizens. The first step in buying a house is determining your budget. This calculator is for information purposes only and does not provide financial advice.

Get Started Today as Rates are Increasing. Lock Your Mortgage Rate Today. Lock Your Mortgage Rate Today.

Ad Its A Home Loan Do-Over. Ad Take Advantage Of Historically Low Mortgage Rates. Ad Todays 10 Best Second Mortgage Rates.

Your annual income before taxes The mortgage term youll be seeking. If you dont know how much your. As part of an.

In this case the borrower would have access to a substantial down payment on a second home. Ad Calculate mortgage rates - adjustable or fixed how much you might qualify for more. Your monthly recurring debt.

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. Calculate what you can afford and more. Our free mortgage calculator can help you estimate your monthly house payments.

A lenders in-house second mortgage calculator will usually give an indication based on a multiple of your income. We do not offer 95 LTV residential. In 2008 the financial market faced a crisis and the property market was also under the crash.

Typically home owners can borrow up to 90 LTV loan to value as a second mortgage on their property. This mortgage calculator will show how much you can afford. How much can I borrow with a second mortgage.

Skip The Bank Save. A 90 LTV mortgage. Apply Easily Get Pre Approved In a Minute.

The interest rate youre likely to earn. Compare Top Home Equity Loans and Save. Apply Now With Quicken Loans.

Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. The minimum mortgage deposit you would need on a second home would be 10 ie. How much can I borrow.

Under this particular formula a person that is earning. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Most lenders will use 45x your salary some may go up to.

The amount will depend on the number of years left on the term the rate whether you have a fixed or variable mortgage and your banks prepayment policies. Put Your Home Equity To Work Pay For Big Expenses. 1 day agoThis generally causes HELOC rates to move up.

With a second mortgage you can borrow against a proportion of the equity you own in a property usually up to around 80-85 to access money to pay for expenses. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. If you want a more accurate quote use our affordability calculator.

Find Out How Much You Can Save With Citizens. Fill in the entry fields. Were Americas Largest Mortgage Lender.

Ad Trusted Reviews Trusted by 45000000. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. Most second home mortgages require at least a 15 deposit and you may need to put down even more than that if your current income wont cover a second mortgage for the.

Were Americas Largest Mortgage Lender. The current average 10-year HELOC rate is 617 but within the last 52 weeks its gone as low as 255 and as high as 620. To qualify for a conventional loan on a second home you will typically need to meet higher credit score standards of 725 or even 750 depending on the lender.

Second Mortgage Calculator. ANZ Home Loans are subject to our lending criteria terms conditions and fees.

Seconds Home Mortgage Rates Are Going Up In 2022

Fha Loan Rules For Second Homes

Second Homes To Become Pricier Despite Low Interest Rates Marketplace

How To Buy A Second Home And Rent The First 7 Tips Faqs

Second Home Mortgage Calculator Vacation Property Online

How To Buy A Second Home With No Down Payment Smartasset

Top Tax Deductions For Second Home Owners

Family Home Loans Family Friendly Neighborhoods Real Estate Investing

/GettyImages-1081824440-2fcd29d1f0974847af9b6f57a3d2ba6d.jpg)

How To Afford A Second Home

How To Buy A Second Property With No Deposit Equity Explained Finder

Buying A Second Home A How To Guide Rocket Mortgage

Why Is Home Equity Important Www Facebook Com Sklentzeris Mortgages101 Mortgage Homesale Homebuying Realtor Sandykle Home Equity Home Equity Loan Equity

Using A Cash Out Refinance To Buy A Second Home A Good Idea Credible

5vjvisnbhz4mtm

Second Home Mortgages Uswitch Explains

How To Use An Fha Loan To Purchase A Second Home

Heloc Infographic Heloc Commerce Bank Mortgage Advice